Buy to let mortgages were first launched at London’s RAC Club on 24 September 1996 by the Association of Residential Letting Agents (ARLA). The buy-to-let term gave a consumer-friendly label to an investment many had never before considered.

At the time of writing this, it’s been 25 years since BTL mortgages were launched and have changed the private rented sector (PRS) for good.

There are three main mortgage categories:

- Residential

- Buy to let

- Let to buy

The type of mortgage you need is determined by the type of property and how you want to use it. I have written in detail on the general mortgage application process. Thus, on this page, I’ll explore buy to let and let to buy mortgages for you.

Different people need a buy to let mortgage for different reasons.

- First-time buyers. Living with parents, have a deposit and regular income which they want to invest in buy to let properties.

- Home movers. These are also called accidental landlords, who could not sell their property on time and decide to let out their current residential property to move onto new residential property.

- Professional landlords. These are the people who buy rental properties to replace regular income and to have a pension income later on in life.

What is a buy to let mortgage?

Buy to let or let to buy mortgages are the same in reality—a mortgage on a property that you are intending to let out.

However, because of a difference in buyer’s situation, these mortgages are named differently.

- Buy to let. When you are purchasing a property to let it out.

- Let to buy. You want to let out a property in which you currently live and moving to a new residential place.

Although, both are mortgages on a rented property. However, lenders have different criteria and products for these two types of mortgages. Not all lenders offer let to buy mortgages, it is worth checking with your mortgage advisor before applying.

What is the difference between a buy to let mortgage and a residential mortgage?

Here are some of the fundamental differences between buy to let (BTL) and residential mortgage:

- Residential mortgages are regulated by the financial conduct authority (FCA) whereas BTL mortgages are not

- BTL mortgage affordability is calculated mainly on the rental income contrary to residential mortgages, which are based on your personal income and expenditures

- Interest only BTL mortgages are common. However, getting an interest-only residential mortgage is difficult and complicated

- BTL property must be in a lettable condition at the time of purchase

- You can’t live in a property with a BTL mortgage. However, you can get consent or permission to let on a residential mortgage.

How does a buy to let mortgage work?

There are two main goals of a buy to let property investor.

- Cash flow

- Capital growth

Cash flow

Most borrowers take out an interest-only buy to let mortgage, which gives them low monthly mortgage payments and better cash flow. Over the next couple of years, Hamptons expect continued yield expansion across the South of England and London in particular.

Cashflow = Monthly rent received – monthly mortgage payment + other letting expenses.

Monthly rental of £1000 minus monthly mortgage payment of £300 and other letting expenses of £200 will give you £500 monthly cash flow from a property.

If one property can give you £500 cash flow, how many properties do you need to replace your regular income? You can simply divide this amount with your regular monthly income.

For example, if your regular monthly income is £5000/£500 = 10 properties, you need to replace your regular monthly income.

Although, your mortgage balance will remain the same at the end of the mortgage term. However, because buy to let properties are not your main home, you can always sell the property and pay off the mortgage.

Capital Growth

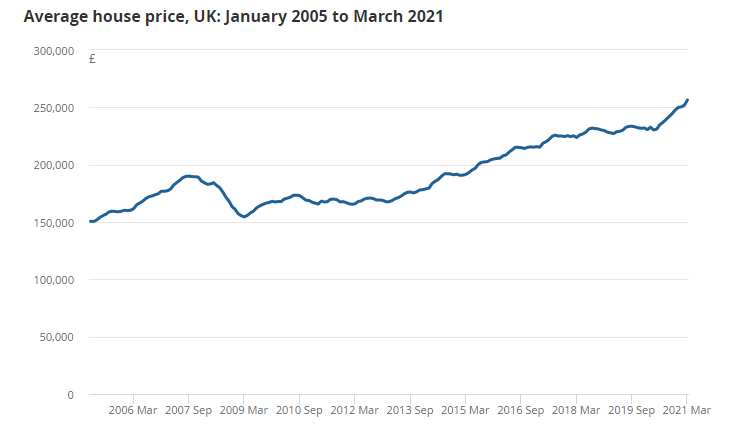

Historically, property prices used to increase over a longer period of time. However, it would be best if you do your research before committing because historical results do not guarantee the same returns in the future.

According to ONS figures, average UK house prices have reached a peak of £256,000 in March 2021.

Many landlords, particularly in London and South East, invest in property for long term capital growth as well as cash flow.

Who can get a buy to let mortgage?

The Buy to Let mortgage process could be considered as being a lot simpler prior to a series of regulatory changes in April 2016.

The process of buying a property to let out using buy to let mortgage was fairly straightforward.

Standard requirements for most buy to let mortgages were:

- You already owned a property

- You have the required deposit

- Have an acceptable credit score

- The selected property is an acceptable security

- Rental income covers the required mortgage amount using a simple rental calculation

However, now on top of the above fundamental requirements, you need to deal with the following as well to purchase a new rental property using a BTL mortgage:

- Extra three per cent stamp duty if you are buying a second property

- Higher rental income tax bill because of the removal of mortgage interest relief

- Lower mortgage amount for two years fixed deals

- Your personal tax bracket affects the mortgage amount you can borrow

- You should buy on the personal name or use special purpose vehicle (SPV) limited company. A big financial decision.

Letting of property is a complicated business and it is important to get appropriate advice. I can advise you on the mortgage but cannot give advice on buying to let as a business proposition.

I recommend you to consult your own independent professional advisers generally and in particular on the following matters: acquisition and disposal costs, management of the property, political and economic factors, business and investment factors and tax.

How to get a buy to let mortgage?

According to a joint report from UK Finance and Hometrack, part of Zoopla December 2019, mortgage brokers account for a still higher proportion of buy-to-let business – close to 90 per cent.

The role of a mortgage broker has grown materially in recent years.

Today, nearly all residential loans – 98 per cent by value – are sold subject to advice. Broadly speaking, brokers originate three-quarters of residential mortgages (measured by value), up from less than half in 2009-12. FTBs rely on mortgage brokers to a greater extent – more than 80 per cent.

Here are a few reasons why a large percentage of landlords use mortgage brokers:

- Complex individual landlord situation

- Prudential regulatory authority (PRA) rental affordability needs

- Portfolio requirements

- Limited company lending

- House in multiple occupation (HMO) and holiday lets

- Bridging and commercial loan needs

With regular criteria, changes by BTL lenders, brokers and good advice is more needed than ever before by landlords.

Buy to let mortgage, how much can I borrow

How much can I borrow on a let to buy mortgage? This depends on the following seven critical factors:

- Property value

- Potential rental value

- Surplus personal income

- Your personal income tax band for personal purchase

- How much you want to borrow (LTV level)

- Is it pound to pound remortgage or capital raising?

- Are you going for two years fixed rate or five

In buy to let cases lender’s valuation report includes the market rental valuation of the subject property on top of the property’s market value and suitable security for lending purposes.

Most lender’s based the maximum loan amount on the property value and rental amount. However, there are few lenders who can consider top-slicing using your surplus personal income to enhance borrowing.

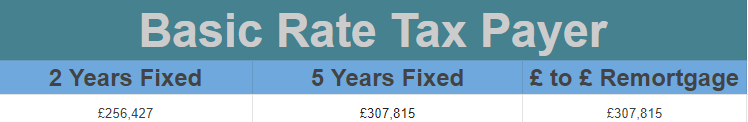

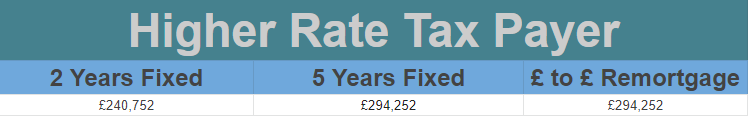

For example, let’s see how much you can borrow from The Mortgage Works based on the following numbers:

Property valuation – £400,000

Anticipated market rent – £1600

This is a simple example of how your personal tax band can affect your borrowing amount.

These numbers are correct at the time of writing this. Lender’s change their lending criteria regularly; therefore, you cannot rely on these numbers. Please check with your mortgage broker or lender for the correct numbers as per your personal situation.

Buy to let mortgage as a first-time buyer

As a first time buyer, you can certainly get a buy to let mortgage, which is often based on the following two extra qualification requirements.

- Your personal income should support the mortgage as well similar to residential mortgage affordability as well as rental calculation.

- Plausibility of buying a buy to let property instead of a residential property

However, I have done a number of first-time buyers buy to let mortgages where applicants were living with parents and have no plan to move out yet. Therefore, they wanted to use their savings to invest in the property.

I also found a lender for them who uses their personal income and potential rental income to calculate the maximum loan amount, which helped them borrow a lot more than what they could afford based on personal income affordability alone.

Conclusion

I hope this buy to let mortgage guide will help you simplify the property investment process. Feel free to message me if I have missed answering your BTL mortgage question.

All the best for your property investment journey!

If you have found this guide helpful, please consider sharing it with family and friends. Sharing this guide can help me spread the word out, and someone become a landlord.