Mortgage in principle is an important part of the puzzle in the process of buying a house.

Instead of bragging about my point of view about mortgage in principle along with all other things attached to getting a mortgage agreement in principle, I have decided to record answers to frequently asked mortgage in principle questions on this page.

I hope this will give you a better understanding of a mortgage in principle and simplify your homeownership journey. You can message me with your question if I missed it on this page.

Let’s get started!

1. What is a mortgage in principle?

A mortgage agreement in principle is the first and important part of the mortgage application process. The mortgage application is divided into two parts.

- Mortgage in principle

- Full application

A decision in principle (DIP) or acceptance in principle (AIP) both are the same things. Some lenders name it DIP, and some call it AIP.

A mortgage in principle acceptance gives you peace of mind that you have passed the lender’s credit score provided that all the information keyed in is accurate and no change in circumstances will be at the application stage.

Most mortgage lenders do not review your mortgage application & the supporting documents until a full application is submitted.

2. How reliable is a mortgage agreement in principle?

Mortgage in principle is like a first job interview to qualify a candidate for the detailed & comprehensive interview. The purpose of this initial interview is to shortlist the best candidates who fulfilled the job requirements to save time & effort for the candidate and the company.

However, qualifying for a detailed interview does not guarantee a job.

Similarly, lenders use the mortgage agreement in principle as a tool to save time & effort for all the parties involved in the mortgage application process to qualify mortgage applicants.

Instead of starting with a full mortgage application, which requires the applicants, mortgage brokers & lenders huge amounts of effort & time to process the applications. A shorter & less demanding decision in principle process saves time for all parties involved.

3. Does an agreement in principle guarantee a mortgage?

Absolutely not.

Like qualifying for a second interview does not guarantee a job. Similarly getting accepted for agreement in principle is just half of the battle.

You still need to pass:

- Underwriter review of your application as per lending criteria

- Assessment of supporting documentation

- Satisfactory replies to any queries underwriter may have before agreeing to your mortgage application

- Acceptable property valuation report for mortgage lending purposes

If you have a mortgage broker, who usually working for you to help find the most appropriate mortgage deal for your needs and circumstances and maximum loan amount. They usually make a best-case scenario that supports your needs, however, it is the lender’s underwriter who has the final say on the requested mortgage lending.

4. How do I get a mortgage in principle?

You can speak to your mortgage broker, bank or get an online mortgage in principle. How reliable your agreement in principle depends on how you obtain it.

Mortgage broker

Your mortgage broker goes through a detailed advice process before providing you with an agreement in principle, which should be reliable provided there are no changes to your circumstances.

Your broker reviews the following before getting you a decision in principle after assessing your demands & needs by completing the full fact.

- Research the whole market to explore the best interest rate & lender as per your circumstances

- Qualify your circumstances against lender criteria

- Review your documentation to minimize the risk of surprises on full application

- Check your affordability as per lender’s affordability calculator

- Ensures the type of property you are purchasing pass the initial lender requirements subject to valuation

In the case of BTL application, even more, checks are required before a broker can advise you on the best product as per your requirements and go for agreement in principle.

This detailed process is designed to maximise your chances of getting a mortgage following a decision in principle and save you, the lender & the broker time.

Direct from a bank

You can obtain the decision in principle from your bank directly if you are confident about the following:

- You qualify for the lending criteria

- You can get the required loan

- Bank has the best rates as per your needs as the bank offers their own products only

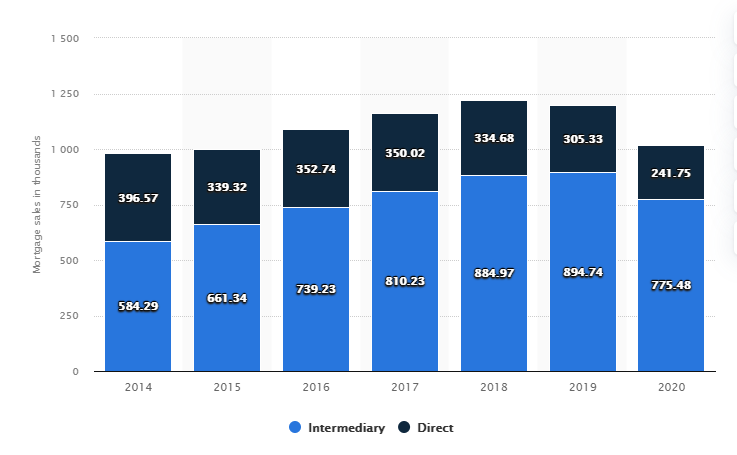

If you are not sure about this, you can save time & money going through a mortgage broker. That’s why a large number of mortgages goes through an intermediary channel.

Online mortgage in principle

Getting an online mortgage in principle must be the quickest way. However, its reliability depends on how confident you are in the following, which your mortgage broker will review for you before getting you the approval from the lender.

- Do you qualify for their lending criteria?

- Can you provide all the required documentation?

- Can you afford the loan as per the lender’s affordability calculator?

- Is the lender offering you the most appropriate product for your needs and circumstances?

- Can the selected lender match your service requirements to support your purchase or remortgage needs?

- Is the property type acceptable to the lender subject to valuation?

For example, I’m working on a first-time buyer buy to let case at the time of writing this. There are only a handful of lenders who accept first-time buyers for a BTL mortgage. Out of that handful of lenders, only one or two offers you the loan amount using your earned income plus the rental income, which improves the loan amount massively.

If you can source with this precision and you are confident about the above list of things where your broker can simplify the process of getting a mortgage you can certainly choose this route.

5. What do I need to get a mortgage in principle?

The more you have in place before you get a mortgage in principle the best to avoid any surprises when it comes to full application.

As a general rule of thumb your broker will ask you the following after completing your fact find:

- Proof of ID

- Proof of Address

- Proof of Income

- Your credit report

- Proof of deposit (for purchase only)

Your broker may ask for more depending on your circumstances. However, this will be a starting point in most cases.

6. What happens after getting an AIP?

Having a formal mortgage approval from a lender gives you a clear idea of your budget so you can search the property as per your budget confidently.

Once you find the property then you can contact your broker or lender to start the full mortgage application process, which involves underwriting & property valuation before a lender can issue a mortgage offer.

7. Do you need an AIP to view a house?

In my opinion, you don’t need it to view the house. Depending on the property market condition in the area you are looking to purchase a house, if there are too many buyers and a shortage of housing stock, most probably estate agents will not process your offer without obtaining agreement in principle.

However, if the estate agents are struggling to find a buyer they will be more likely to entertain any interested buyer.

8. How long does a mortgage in principle last?

It varies from lender to lender and the validity of the agreement in principle could be anywhere from 30 days to six months depending on the lender.

Also, if any change in your circumstances, it should be reviewed before going to the full application to avoid any surprises down the line. On the flip side, if there isn’t any change in your circumstances, renewing your decision in principle should not be a problem if it expires.

9. Does a mortgage in principle affect your credit score?

According to Equifax when you request a copy of your credit report or check credit scores, that’s known as a “soft” inquiry. Other types of soft inquiries result from companies that send you promotional credit card offers and existing lending account reviews by companies with whom you have an account. Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay on your credit reports for 12 to 24 months, depending on the type.

The other type of inquiry is a “hard” inquiry. Those occur after you have applied for a loan or a credit card and the potential lender reviews your credit history.

When you apply for an AIP, the lender will ask for your permission to run a credit check. It is a good idea to check before going ahead whether it will be a ‘hard’ credit check or a ‘soft’ to make an informed decision.

10. Why was my mortgage rejected after agreement in principle?

An AiP is just an indication from the lender that they can consider lending you and doesn’t guarantee a mortgage.

Before any lender can issue you a mortgage offer, they:

- Review the provided information on the application

- Assess supporting documents

- Go through your credit history

- Check affordability

- Ensure property is a suitable mortgage security

Anything could happen between AIP & getting a mortgage offer.

I hope this has given you an in-depth knowledge of a mortgage in principle to simplify your homeownership journey.

You can message me with your question if I missed an answer on this page.

If you have found these answers helpful, please consider sharing it with family & friends. Sharing these answers can help me spread the word out, and someone become a homeowner.